- eCorp - Online Business Banking

- Mobile Banking for Business

- Mobile Deposit for Business

- Foreign Exchange Services

- Paperless Statements and Email Notification

- Online Bill Pay

- Positive Pay

- Remote Deposit

eCorp – Online Business Banking

Waukesha State Bank's eCorp - Online Banking for Business gives you more than just the ability to view your account activity online. With our comprehensive suite of services, you can turn your office computer into your own online branch.

With eCorp Online Banking you can view images of checks you have issued and deposited, pay bills, submit payroll files, make deposits, transfer money between your accounts and download your account activity into popular money management software - all from the comfort of your office, whenever you need to do business.

The Basic eCorp services listed below (unless otherwise stated) are available free for most Small Business and Not-for-Profit customers; however, the eCorp fee is based on the type of business checking account and the eCorp services you have. Please check our business checking options for details. Additional Terms and Conditions may apply.

Basic eCorp:

- Monitor account activity in real time

- Set up Notifi: Real-Time Account Alerts and choose from dozens of account activity notifications

- View up to 12 months of account activity

- Research up to 18 months of account statements

- View and print images of paper transactions

- Export transactions to popular money management software

- Transfer funds between your eCorp accounts

- Make advances from your Waukesha State Bank line of credit to your accounts

- Make Waukesha State Bank loan payments

- Pay bills with Business Online Bill Pay*

- Receive Paperless Statements and Email Notifications for FREE

- Optional Positive Pay anti-check fraud protection service*

- Optional Remote Deposit*

Enhanced eCorp:

All of the abilities of Basic eCorp, plus:

- Create ACH electronic funds transfers between your accounts at Waukesha State Bank and other financial institutions

- Create ACH file transfers to pay your employees or collect recurring donations or membership fees

- Initiate wire transfers from the convenience of your office

For ACH users, click below for full NACHA Rules & Guidelines, as well as a guide for Originator Quick Reference Cards.

*Additional fees, terms and conditions may apply.

System Requirements

The use of a browser supporting 128-bit encryption. We recommend using the most recent and supported versions of Microsoft Edge, Chrome or Firefox. Other Internet browsers may work, but we cannot guarantee that all functions will be available.

We also recommend using the most recent and supported version of Adobe Reader. Other versions may work, but we cannot guarantee that all functions will be available.

Interested?

Contact your Personal Banker to enroll or click here to view a demo.

Mobile Banking for Business+

Manage your finances faster and more effectively than ever using your smartphone! Simply download the FREE Waukesha State Bank Business App to your smartphone, and you can do most of the functions that you can on your computer, such as:

- Viewing balances and transactions

- Initiating internal transfers

- Approve Positive Pay exceptions (if applicable)

- And MORE!

For current eCorp Online Banking users, simply go to the app store and download the Waukesha State Bank Business App (be sure to install the Business App and not the Personal App). If you aren’t already using eCorp Online Banking, contact your Personal Banker to enroll.

+Requires eCorp Online Banking.

Mobile Deposit for Business

Make deposits anywhere, anytime, with your smartphone and our Waukesha State Bank Business App! It's convenient, safe, easy and FREE!

- Deposit checks the moment you get them.

- Simply endorse your check, take a picture of the front and back, and submit the deposit.**

- Plus... Deposits are always FREE!

To activate Mobile Deposit for Business, current eCorp users can simply contact our Electronic Banking department at (262) 953-2445. If you aren’t already using eCorp Online Banking, contact your Personal Banker to enroll.

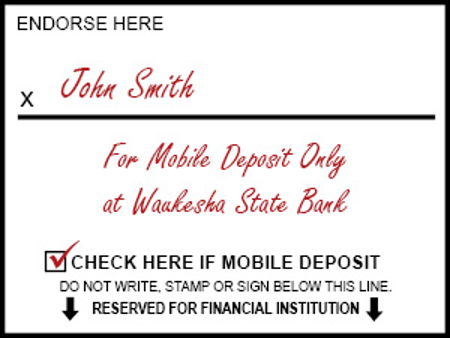

How should you endorse your check for mobile check deposit?

Before depositing your check via mobile deposit, please make sure to endorse the check by signing the back and writing “FOR MOBILE DEPOSIT ONLY AT WAUKESHA STATE BANK.”

Funds are available the next business day when the deposit status is confirmed.

PLEASE NOTE: Proper endorsement is required.

If you have any questions, call our Customer Service Center at (262) 549-8500, or visit with our friendly Personal Bankers at any of our convenient office locations.

**If your deposit is accepted before 5:30 PM central time, funds are normally available the next business day. Maximum deposit amount per day is $4,000. After the deposit has been received, you agree to securely store and retain the check(s) for at least 14 calendar days from the date of the image transmission, promptly supply the check(s) to the bank if requested, and shred the check(s) after 14 days.

Foreign Exchange Services

Waukesha State Bank provides international market support through our foreign exchange services, which include:

- Foreign currency exchange (access to more than 50 currencies with same day service for select currencies)

- Euros

- Pounds

- Canadian Dollars

- Mexican Pesos

- Japanese Yen

- And More!

- Additionally, we accept foreign denominated checks.

- Wire transfers

- Directo a México

- Multi-currency accounts

To learn more, visit with your friendly Commercial or Personal Banker at one of our offices.

Paperless Statements and Email Notification

Eliminate the risk that your statements and account information could be lost in the mail. Paperless Statements and Email Notifications are a secure and convenient way to view your account information whenever you want, and are available free to all of our Online Banking customers. Receive email notifications when account statements and other important documents (such as NSF notices, mortgage loan billing statements, certificate maturity reminders, etc.) are available for you to view right through your eCorp access.

Additionally, all Online Banking customers who register for Paperless Statements can use our Online Bill Pay^ service for free.

Interested?

If, at any time, you prefer to revert to receiving paper mailings or need to change your email address:

- Stop into one of our full service banking locations,

- Call our Customer Service Center at (262) 549-8520, or

- Write to us at:

Waukesha State Bank

Attn: Electronic Banking

PO Box 648

Waukesha, WI 53187-0648

^Without Paperless Statements, a monthly fee of $6.00 applies.

Business Online Bill Pay

Pay your bills directly from your business checking account 24 hours a day; 7 days a week from anywhere you have access to the Internet.

Our Online Bill Pay service is flexible enough to meet the demands of your business' schedule.

- No per-transaction fees

- Pay one-time bills or schedule regular payments automatically from your account on the day you choose

- Setup reminders to be sent to your email notifying you of bills coming due

- Receive bills electronically through eBill

Best of all, Online Bill Pay is free to customer's with Paperless Statements and only $6.00 per month for customers without Paperless Statements.

Interested?

Positive Pay

Positive Pay is an effective anti-fraud tool that only allows pre-authorized checks and ACH transactions to go in and out of your account. You will be alerted to any exceptions and can approve or deny them, reducing the risk for potential fraud.

Check Positive Pay

Check Positive Pay enables Waukesha State Bank to match information about the checks your business issues to the checks being presented to the Bank.

The process is simple: Once logged into eCorp, your business uploads a file containing a list of the checks you have issued, including the account number, check number, dollar amount and issue date of each item. When the checks are presented for payment, we compare them to the information your business already provided, and alert you to any exceptions.

Check Positive Pay features:

- Real-time verification of check number, check amount and payee

- Template building and uploading options

- Report writing and exporting capabilities

ACH Positive Pay

ACH Positive Pay enables you to pre-authorize ACH transactions to post to your account. If an ACH is presented that falls outside of the filters you set up, you will be alerted and can approve or deny the transaction before it posts to your account.

The process is simple: Once logged into eCorp, you set up filters that pre-authorize ACH transactions to post to your account. It lets you easily identify trusted trading partners and to automatically populate a filter for future transactions. You can also set expiration dates, amount limits and more.

ACH Positive Pay features:

- Control external account debits and credits

- Experience real-time ACH approvals, which can occur before a transaction posts

- Eliminate the need to maintain labor-intensive ACH filters with real-time approvals

The Benefits of Positive Pay:

- It reduces the risk of fraud by detecting counterfeit items, items having duplicate check numbers, voided checks presented for payment, stolen checks, checks with altered amounts and unauthorized ACH transactions.

- It identifies exception items when they are presented, rather than waiting for a monthly bank statement, reducing the amount of time spent on reconciling the account.

- It enables the business to review exception items in eCorp at the beginning of the business day, and flag the items with a pay/no pay instruction.

Interested?

Remote Deposit

Deposit checks electronically from your computer using Remote Deposit, the quickest way to turn check deposits into cash. Remote Deposit is like having a 24-hour bank teller right in your office. It utilizes a desktop scanner that connects to your PC and the Internet. With it, you can:

- Make deposits anytime

- Save time preparing deposits

- Cut costly courier fees or trips to the bank

- Reduce risk of check fraud

- Consolidate funds from multiple remote locations into one bank

Plus, Remote Deposit features multiple layers of security, including multifactor authentication password protection and session timeouts.

How does it work?

- Prepare the deposit

- Scan the checks from any desktop computer

- Electronically send the deposit to the bank

- The funds are deposited into your account

To use Remote Deposit, you will need:

- Account with Waukesha State Bank

- eCorp - Online Banking for Business

- Desktop check scanner and software (provided by Waukesha State Bank)

- Soft or hard token device.

- Internet connection. We recommend using the most recent and supported versions of Microsoft Edge, Chrome or Firefox.

Is Remote Deposit right for you?

Remote Deposit may benefit your company if your business has multiple locations, you make deposits after normal banking hours, you pay transportation costs to deliver deposits to the bank or you receive checks with large dollar amounts.

Interested?

Payroll Made Easy

Focus on running your business and leave the payroll services to us!